Georgism

Georgism, also called in modern times geoism[2] and known historically as the single tax movement, is an economic ideology holding that, although people should own the value they produce themselves, the economic rent derived from land – including from all natural resources, the commons, and urban locations – should belong equally to all members of society.[3][4][5] Developed from the writings of American economist and social reformer Henry George, the Georgist paradigm seeks solutions to social and ecological problems, based on principles of land rights and public finance which attempt to integrate economic efficiency with social justice.[6][7]

Georgism is concerned with the distribution of economic rent caused by natural monopolies, pollution and the control of commons, including title of ownership for natural resources and other contrived privileges (e.g. intellectual property). Any natural resource which is inherently limited in supply can generate economic rent, but the classical and most significant example of land monopoly involves the extraction of common ground rent from valuable urban locations. Georgists argue that taxing economic rent is efficient, fair and equitable. The main Georgist policy recommendation is a tax assessed on land value. Georgists argue that revenues from a land value tax (LVT) can be used to reduce or eliminate existing taxes such as on income, trade, or purchases that are unfair and inefficient. Some Georgists also advocate for the return of surplus public revenue to the people by means of a basic income or citizen's dividend.

The concept of gaining public revenues mainly from land and natural resource privileges was widely popularized by Henry George through his first book, Progress and Poverty (1879). The philosophical basis of Georgism dates back to several early thinkers such as John Locke,[8] Baruch Spinoza[9] and Thomas Paine.[10] Economists since Adam Smith and David Ricardo have observed that a public levy on land value does not cause economic inefficiency, unlike other taxes.[11][12] A land value tax also has progressive tax effects.[13][14] Advocates of land value taxes argue that they would reduce economic inequality, increase economic efficiency, remove incentives to underutilize urban land and reduce property speculation.[15]

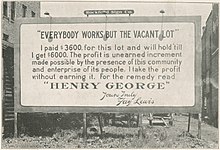

Georgist ideas were popular and influential during the late 19th and early 20th century.[16] Political parties, institutions and communities were founded based on Georgist principles during that time. Early devotees of Henry George's economic philosophy were often termed Single Taxers for their political goal of raising public revenue mainly or only from a land value tax, although Georgists endorsed multiple forms of rent capture (e.g. seigniorage) as legitimate.[17] The term Georgism was invented later, and some prefer the term geoism as more generic.[18][19]

Main tenets[edit source]

Henry George is best known for popularizing the argument that government should be funded by a tax on land rent rather than taxes on labor. George believed that although scientific experiments could not be performed in political economy, theories could be tested by comparing different societies with different conditions and by thought experiments about the effects of various factors.[20] Applying this method, he concluded that many of the problems that beset society, such as poverty, inequality, and economic booms and busts, could be attributed to the private ownership of the necessary resource, land rent. In his most celebrated book, Progress and Poverty, George argues that the appropriation of land rent for private use contributes to persistent poverty in spite of technological progress, and causes economies to exhibit a tendency toward boom and bust cycles. According to George, people justly own what they create, but natural opportunities and land belong equally to all.[4]

George believed there was an important distinction between common and collective property.[21] Although equal rights to land might be achieved by nationalizing land and then leasing it to private users, George preferred taxing unimproved land value and leaving the control of land mostly in private hands. George's reasoning for leaving land in private control and slowly shifting to land value tax was that it would not penalize existing owners who had improved land and would also be less disruptive and controversial in a country where land titles have already been granted.

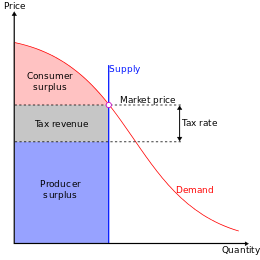

Georgists have observed that privately created wealth is socialized via the tax system (e.g., through income and sales tax), while socially created wealth in land values are privatized in the price of land titles and bank mortgages. The opposite would be the case if land rents replaced taxes on labor as the main source of public revenue; socially created wealth would become available for use by the community, while the fruits of labor would remain private.[22] According to Georgists, a land value tax can be considered a user fee instead of a tax, since it is related to the market value of socially created locational advantage, the privilege to exclude others from locations. Assets consisting of commodified privilege can be considered as wealth since they have exchange value, similar to taxi medallions.[23][failed verification] A land value tax, charging fees for exclusive use of land, as a means of raising public revenue is also a progressive tax tending to reduce economic inequality,[13][14] since it applies entirely to ownership of valuable land, which is correlated with income,[24] and there is generally no means by which landlords can shift the tax burden onto tenants or laborers. Landlords are unable to pass the tax on to tenants because the supply and demand of rented land is unchanged. Because the supply of land is perfectly inelastic, land rents depend on what tenants are prepared to pay, rather than on the expenses of landlords, and so the tax cannot be passed on to tenants.[25]

Economic properties[edit source]

| Part of a series on |

| Economics |

|---|

Standard economic theory suggests that a land value tax would be extremely efficient – unlike other taxes, it does not reduce economic productivity.[15] Milton Friedman described Henry George's tax on unimproved value of land as the "least bad tax", since unlike other taxes, it would not impose an excess burden on economic activity (leading to zero or even negative "deadweight loss"); hence, a replacement of other more distortionary taxes with a land value tax would improve economic welfare.[26] As land value tax can improve the use of land and redirect investment toward productive, non-rent-seeking activities, it could even have a negative deadweight loss that boosts productivity.[27] Because land value tax would apply to foreign land speculators, the Australian Treasury estimated that land value tax was unique in having a negative marginal excess burden, meaning that it would increase long-run living standards.[28]

It was Adam Smith who first noted the efficiency and distributional properties of a land value tax in his book The Wealth of Nations.[11]

Benjamin Franklin and Winston Churchill made similar distributional and efficient arguments for taxing land rents. They noted that the costs of taxes and the benefits of public spending always eventually apply to and enrich, respectively, the owners of land. Therefore, they believed it would be best to defray public costs and recapture value of public spending by applying public charges directly to owners of land titles, rather than harming public welfare with taxes assessed against beneficial activities such as trade and labor.[29][30]

Henry George wrote that his plan for a high land value tax would cause people "to contribute to the public, not in proportion to what they produce ... but in proportion to the value of natural [common] opportunities that they hold [monopolize]". He went on to explain that "by taking for public use that value which attaches to land by reason of the growth and improvement of the community", it would, "make the holding of land unprofitable to the mere owner, and profitable only to the user".

A high land value tax would discourage speculators from holding valuable natural opportunities (like urban real estate) unused or only partially used. Henry George claimed this would have many benefits, including the reduction or elimination of tax burdens from poorer neighborhoods and agricultural districts; the elimination of a multiplicity of taxes and expensive obsolete government institutions; the elimination of corruption, fraud, and evasion with respect to the collection of taxes; the enablement of true free trade; the destruction of monopolies; the elevation of wages to the full value of labor; the transformation of labor-saving inventions into blessings for all; and the equitable distribution of comfort, leisure, and other advantages that are made possible by an advancing civilization.[31] In this way, the vulnerability that market economies have to credit bubbles and property manias would be reduced.[15]

[edit source]

Income flow resulting from payments for restricted access to natural opportunities or for contrived privileges over geographic regions is termed economic rent. Georgists argue that economic rent of land, legal privileges, and natural monopolies should accrue to the community, rather than private owners. In economics, "land" is everything that exists in nature independent of human activity. George explicitly included climate, soil, waterways, mineral deposits, laws/forces of nature, public ways, forests, oceans, air, and solar energy in the category of land.[32] While the philosophy of Georgism does not say anything definitive about specific policy interventions needed to address problems posed by various sources of economic rent, the common goal among modern Georgists is to capture and share (or reduce) rent from all sources of natural monopoly and legal privilege.[33][34]

Henry George shared the goal of modern Georgists to socialize or dismantle rent from all forms of land monopoly and legal privilege. However, George emphasized mainly his preferred policy known as land value tax, which targeted a particular form of unearned income known as ground rent. George emphasized ground-rent because basic locations were more valuable than other monopolies and everybody needed locations to survive, which he contrasted with the less significant streetcar and telegraph monopolies, which George also criticized. George likened the problem to a laborer traveling home who is waylaid by a series of highway robbers along the way, each who demand a small portion of the traveler's wages, and finally at the very end of the road waits a robber who demands all that the traveler has left. George reasoned that it made little difference to challenge the series of small robbers when the final robber remained to demand all that the common laborer had left.[35] George predicted that over time technological advancements would increase the frequency and importance of lesser monopolies, yet he expected that ground rent would remain dominant.[36] George even predicted that ground-rents would rise faster than wages and income to capital, a prediction that modern analysis has shown to be plausible, since the supply of land is fixed.[37]

Spatial rent is still the primary emphasis of Georgists because of its large value and the known diseconomies of misused land. However, there are other sources of rent that are theoretically analogous to ground-rent and are debated topics of Georgists. The following are some sources of economic rent.[38][39][40]

- Extractable resources (minerals and hydrocarbons)[41][42]

- Severables (forests and stocks of fish)[34][43][44]

- Extraterrestrial domains (geosynchronous orbits and airway corridor use)[39][40]

- Legal privileges that apply to specific location (taxi medallions, billboard and development permits, or the monopoly of electromagnetic frequencies)[39][40]

- Restrictions/taxes of pollution or severance (tradable emission permits and fishing quotas)[33][39][40]

- Right-of-way (transportation) used by railroads, utilities, and internet service providers[45][46][47]

- Issuance of legal tender (see seigniorage)[33][48]

- Privileges that are less location dependent but that still exclude others from natural opportunities (patents)[49][50]

Where free competition is impossible, such as telegraphs, water, gas, and transportation, George wrote, "[S]uch business becomes a proper social function, which should be controlled and managed by and for the whole people concerned." Georgists were divided by this question of natural monopolies and often favored public ownership only of the rents from common rights-of-way, rather than public ownership of utility companies themselves.[31]

Georgism and environmental economics[edit source]

The early conservationism of the Progressive Era was inspired partly by Henry George and his influence extended for decades afterward.[51] Some ecological economists still support the Georgist policy of land value tax as a means of freeing or rewilding unused land and conserving nature by reducing urban sprawl.[52][53][54]

Pollution degrades the value of what Georgists consider to be commons. Because pollution is a negative contribution, a taking from the commons or a cost imposed on others, its value is economic rent, even when the polluter is not receiving an explicit income. Therefore, to the extent that society determines pollution to be harmful, most Georgists propose to limit pollution with taxation or quotas that capture the resulting rents for public use, restoration, or a citizen's dividend.[33][55][56]

Georgism is related to the school of ecological economics, since both propose market-based restrictions for pollution.[52][57] The schools are compatible in that they advocate using similar tools as part of a conservation strategy, but they emphasize different aspects. Conservation is the central issue of ecology, whereas economic rent is the central issue of geoism. Ecological economists might price pollution fines more conservatively to prevent inherently unquantifiable damage to the environment, whereas Georgists might emphasize mediation between conflicting interests and human rights.[34][58] Geolibertarianism, a market-oriented branch of geoism, tends to take a direct stance against what it perceives as burdensome regulation and would like to see auctioned pollution quotas or taxes replace most command and control regulation.[59]

Since ecologists are primarily concerned with conservation, they tend to emphasize less the issue of equitably distributing scarcity/pollution rents, whereas Georgists insist that unearned income not accrue to those who hold title to natural assets and pollution privilege. To the extent that geoists recognize the effect of pollution or share conservationist values, they will agree with ecological economists about the need to limit pollution, but geoists will also insist that pollution rents generated from those conservation efforts do not accrue to polluters and are instead used for public purposes or to compensate those who suffer the negative effects of pollution. Ecological economists advocate similar pollution restrictions but, emphasizing conservation first, might be willing to grant private polluters the privilege to capture pollution rents. To the extent that ecological economists share the geoist view of social justice, they would advocate auctioning pollution quotas instead of giving them away for free.[52] This distinction can be seen in the difference between basic cap and trade and the geoist variation, cap and share, a proposal to auction temporary pollution permits, with rents going to the public, instead of giving pollution privilege away for free to existing polluters or selling perpetual permits.[60][61]

Revenue uses[edit source]

The revenue can allow the reduction or elimination of taxes, greater public investment/spending, or the direct distribution of funds to citizens as a pension or basic income/citizen's dividend.[34][62][63]

In practice, the elimination of all other taxes implies a high land value tax, greater than any currently existing land tax. Introducing or increasing a land value tax would cause the purchase price of land to decrease. George did not believe landowners should be compensated and described the issue as being analogous to compensation for former slave owners. Other geoists disagree on the question of compensation; some advocate complete compensation while others endorse only enough compensation required to achieve Georgist reforms. Some geoists advocate compensation only for a net loss due to a shift of taxation to land value; most taxpayers would gain from the replacement of other taxes with a tax on land value. Historically, those who advocated for taxes on rent tax only great enough to replace other taxes were known as endorsers of single tax limited.

Synonyms and variants[edit source]

Most early advocacy groups described themselves as single taxers and George reluctantly accepted the single tax as an accurate name for his main political goal—the repeal of all unjust or inefficient taxes, to be replaced with a land value tax (LVT).

Some modern proponents are dissatisfied with the name Georgist. While Henry George was well known throughout his life, he has been largely forgotten by the public and the idea of a single tax of land predates him. Some now prefer the term geoism,[19][64] with the meaning of geo (from Greek γῆ gē "earth, land", as incidentally is in Greek the first compound of the name George (whence Georgism) < (Gr.) Geōrgios < geōrgos "farmer" or geōrgia "agriculture, farming" < gē + ergon "work")[65][66] deliberately ambiguous. The terms Earth Sharing,[67] geonomics[68] and geolibertarianism[69] are also used by some Georgists. These terms represent a difference of emphasis and sometimes real differences about how land rent should be spent (citizen's dividend or just replacing other taxes), but they all agree that land rent should be recovered from its private recipients.

Compulsory fines and fees related to land rents are the most common Georgist policies, but some geoists prefer voluntary value capture systems that rely on methods such as non-compulsory or self-assessed location value fees, community land trusts[70] and purchasing land value covenants.[71][72][73][74][75] Some geoists believe that partially compensating landowners is a politically expedient compromise necessary for achieving reform.[76][77] For similar reasons, others propose capturing only future land value increases, instead of all land rent.[78]

Although Georgism has historically been considered as a radically progressive or socialist ideology, some libertarians and minarchists take the position that limited social spending should be financed using Georgist concepts of rent value capture, but that not all land rent should be captured. Today, this relatively conservative adaptation is usually considered incompatible with true geolibertarianism, which requires that excess rents be gathered and then distributed back to residents. During Henry George's time, this restrained Georgist philosophy was known as "single tax limited", as opposed to "single tax unlimited". George disagreed with the limited interpretation, but he accepted its adherents (e.g. Thomas Shearman) as legitimate "single-taxers".[79]

Influence[edit source]

Georgist ideas heavily influenced the politics of the early 20th century. Political parties that were formed based on Georgist ideas include the United States Commonwealth Land Party, the Henry George Justice Party, the Single Tax League, and Denmark's Justice Party.

In the United Kingdom, the Liberal government included a land tax as part of several taxes in the 1909 People's Budget intended to redistribute wealth (including a progressively graded income tax and an increase of inheritance tax). This caused a political crisis that resulted indirectly in reform of the House of Lords. The budget was passed eventually—but without the land tax. In 1931, the minority Labour government passed a land value tax as part III of the 1931 Finance act. However, this was repealed in 1934 by the National Government before it could be implemented.

In Denmark, the Georgist Justice Party has previously been represented in Folketinget. It formed part of a centre-left government 1957–60 and was also represented in the European Parliament 1978–1979. The influence of Henry George has waned over time, but Georgist ideas still occasionally emerge in politics. For the United States 2004 presidential election, Ralph Nader mentioned George in his policy statements.[80]

Economists still generally favor a land value tax.[81] Milton Friedman publicly endorsed the Georgist land value tax as the "least bad tax".[12] Joseph Stiglitz stated that: "Not only was Henry George correct that a tax on land is non-distortionary, but in an equilibrium society … tax on land raises just enough revenue to finance the (optimally chosen) level of government expenditure."[82] He dubbed this proposition the Henry George theorem.[83]

Communities[edit source]

Several communities were also initiated with Georgist principles during the height of the philosophy's popularity. Two such communities that still exist are Arden, Delaware, which was founded in 1900 by Frank Stephens and Will Price, and Fairhope, Alabama, which was founded in 1894 under the auspices of the Fairhope Single Tax Corporation.[84] Some established communities in the United States also adopted Georgist tax policies. A Georgist in Houston, Texas, Joseph Jay "J.J." Pastoriza, promoted a Georgist club in that city established in 1890. Years later, in his capacity as a city alderman, he was selected to serve as Houston Tax Commissioner, and promulgated a "Houston Plan of Taxation" in 1912. Improvements to land and merchants' inventories were taxed at 25 percent of the appraised value, unimproved land was taxed at 70 percent of appraisal, and personal property was exempt. This Georgist tax continued until 1915, when two courts struck it down as violating the Texas Constitution in 1915. This quashed efforts in several other Texas cities which took steps towards implementing the Houston Plan in 1915: Beaumont, Corpus Christi, Galveston, San Antonio, and Waco.[85]

The German protectorate of the Kiautschou Bay concession in Jiaozhou Bay, China fully implemented Georgist policy. Its sole source of government revenue was the land value tax of six percent which it levied in its territory. The German government had previously had economic problems with its African colonies caused by land speculation. One of the main reasons for using the land value tax in Jiaozhou Bay was to eliminate such speculation, which the policy achieved.[86] The colony existed as a German protectorate from 1898 until 1914, when seized by Japanese and British troops. In 1922 the territory was returned to China.

Georgist ideas were also adopted to some degree in Australia, Hong Kong, Singapore, South Africa, South Korea, and Taiwan. In these countries, governments still levy some type of land value tax, albeit with exemptions.[87] Many municipal governments of the US depend on real property tax as their main source of revenue, although such taxes are not Georgist as they generally include the value of buildings and other improvements. One exception is the town of Altoona, Pennsylvania, which for a time in the 21st century only taxed land value, phasing in the tax in 2002, relying on it entirely for tax revenue from 2011, and ending it 2017; the Financial Times noted that "Altoona is using LVT in a city where neither land nor buildings have much value".[88][89]

Institutes and organizations[edit source]

Various organizations still exist that continue to promote the ideas of Henry George. According to The American Journal of Economics and Sociology, the periodical Land&Liberty, established in 1894, is "the longest-lived Georgist project in history".[90] Founded during the Great Depression in 1932, the Henry George School of Social Science in New York offers courses, sponsors seminars, and publishes research in the Georgist paradigm.[91] Also in the US, the Lincoln Institute of Land Policy was established in 1974 based on the writings of Henry George. It "seeks to improve the dialogue about urban development, the built environment, and tax policy in the United States and abroad".[92]

The Henry George Foundation continues to promote the ideas of Henry George in the United Kingdom.[93] The IU is an international umbrella organisation that brings together organizations worldwide that seek land value tax reform.[94]

Reception[edit source]

The economist Alfred Marshall believed that George's views in Progress and Poverty were dangerous, even predicting wars, terror, and economic destruction from the immediate implementation of its recommendations. Specifically, Marshall was upset about the idea of rapid change and the unfairness of not compensating existing landowners. In his lectures on Progress and Poverty, Marshall opposed George's position on compensation while fully endorsing his ultimate remedy. So far as land value tax moderately replaced other taxes and did not cause the price of land to fall, Marshall supported land value taxation on economic and moral grounds, suggesting that a three or four percent tax on land values would fit this condition. After implementing land taxes, governments would purchase future land values at discounted prices and take ownership after 100 years. Marshall asserted that this plan, which he strongly supported, would end the need for a tax collection department of government. For newly formed countries where land was not already private, Marshall advocated implementing George's economic proposal immediately.[95][96]

Karl Marx considered the Single Tax platform as a regression from the transition to communism and referred to Georgism as "Capitalism’s last ditch".[97] Marx argued that, "The whole thing is ... simply an attempt, decked out with socialism, to save capitalist domination and indeed to establish it afresh on an even wider basis than its present one."[98] Marx also criticized the way land value tax theory emphasizes the value of land, arguing that, "His fundamental dogma is that everything would be all right if ground rent were paid to the state."[98] Georgists such as Fred Harrison (2003) replied to these Marxist objections.[99]

Richard T. Ely, known as the "Father of Land Economics",[citation needed] agreed with the economic arguments for Georgism but believed that correcting the problem the way Henry George wanted (without compensation) was unjust to existing landowners. In explaining his position, Ely wrote that "If we have all made a mistake, should one party to the transaction alone bear the cost of the common blunder?"[100]

John R. Commons supported Georgist economics, but opposed what he perceived as an environmentally and politically reckless tendency for advocates to rely on a one-size-fits-all approach to tax reform, specifically, the "single tax" framing. Commons concluded The Distribution of Wealth, with an estimate that "perhaps 95% of the total values represented by these millionnaire [sic] fortunes is due to those investments classed as land values and natural monopolies and to competitive industries aided by such monopolies", and that "tax reform should seek to remove all burdens from capital and labour and impose them on monopolies". However, he criticized Georgists for failing to see that Henry George's anti-monopoly ideas must be implemented with a variety of policy tools. He wrote, "Trees do not grow into the sky—they would perish in a high wind; and a single truth, like a single tax, ends in its own destruction." Commons uses the natural soil fertility and value of forests as an example of this destruction, arguing that a tax on the in situ value of those depletable natural resources can result in overuse or over-extraction. Instead, Commons recommends an income tax based approach to forests similar to a modern Georgist severance tax.[101][102]

Other contemporaries such as Austrian economist Frank Fetter and neoclassical economist John Bates Clark argued that it was impractical to maintain the traditional distinction between land and capital, and used this as a basis to attack Georgism. Mark Blaug, a specialist in the history of economic thought, credits Fetter and Clark with influencing mainstream economists to abandon the idea "that land is a unique factor of production and hence that there is any special need for a special theory of ground rent" claiming that "this is in fact the basis of all the attacks on Henry George by contemporary economists and certainly the fundamental reason why professional economists increasingly ignored him".[103]

Robert Solow endorsed the theory of Georgism, but is wary of the perceived injustice of expropriation. Solow stated that taxing away expected land rents "would have no semblance of fairness"; however, Georgism would be good to introduce where location values were not already privatized or if the transition could be phased in slowly.[104]

George has also been accused of exaggerating the importance of his "all-devouring rent thesis" in claiming that it is the primary cause of poverty and injustice in society.[105] George argued that the rent of land increased faster than wages for labor because the supply of land is fixed. Modern economists, including Ottmar Edenhofer have demonstrated that George's assertion is plausible but was more likely to be true during George's time than now.[37]

An early criticism of Georgism was that it would generate too much public revenue and result in unwanted growth of government, but later critics argued that it would not generate enough income to cover government spending. Joseph Schumpeter concluded his analysis of Georgism by stating that, "It is not economically unsound, except that it involves an unwarranted optimism concerning the yield of such a tax." Economists who study land conclude that Schumpeter's criticism is unwarranted because the rental yield from land is likely much greater than what modern critics such as Paul Krugman suppose.[106] Krugman agrees that land value taxation is the best means of raising public revenue but asserts that increased spending has rendered land rent insufficient to fully fund government.[107] Georgists have responded by citing studies and analyses implying that land values of nations like the US, UK, and Australia are more than sufficient to fund all levels of government.[108][109][110][111][112][113][114]

Anarcho-capitalist political philosopher and economist Murray Rothbard criticized Georgism in Man, Economy, and State as being philosophically incongruent with subjective value theory, and further stating that land is irrelevant in the factors of production, trade, and price systems,[115] but this critique is seen by some, including other opponents of Georgism, as relying on false assumptions and flawed reasoning.[116]

Austrian economist Friedrich Hayek credited early enthusiasm for Henry George with developing his interest in economics. Later, Hayek said that the theory of Georgism would be very strong if assessment challenges did not result in unfair outcomes, but he believed that they would.[117]

Notable Georgists[edit source]

Economists[edit source]

- Harry Gunnison Brown[118]

- John R. Commons[119][120][121]

- Raymond Crotty[122][123]

- Herman Daly[124]

- Paul Douglas[125][126]

- Ottmar Edenhofer[127][128][129]

- Fred Foldvary[130]

- Milton Friedman[131]

- Mason Gaffney[132][133]

- Max Hirsch[134]

- Harold Hotelling[135][136][137][138]

- Wolf Ladejinsky[139]

- Donald Shoup[140][141][142]

- Herbert A. Simon[143]

- Robert Solow[104]

- Joseph Stiglitz[144]

- Nicolaus Tideman[145]

- William Vickrey[146][147][148]

- Léon Walras[149]

- Philip Wicksteed[150]

- Michael Hudson[151][152]

Heads of government[edit source]

Other political figures[edit source]

- John Peter Altgeld[168][169]

- Newton D. Baker[170][171]

- Willie Brown[172]

- Clyde Cameron[173]

- George F. Cotterill[174][175][176]

- William Jay Gaynor[177]

- Frederic C. Howe[178]

- Blas Infante[179]

- Tom L. Johnson[180]

- Samuel M. Jones[181]

- Frank de Jong[182]

- Franklin Knight Lane[170]

- Hazen S. Pingree[183][184][185]

- Philip Snowden[186][187]

- Josiah C. Wedgwood

- William Bauchop Wilson[170]

- Jackson Stitt Wilson[188][189]

- Andrew MacLaren MP[190]

- Joshua Nkomo[191]

- Baldomero Argente[192]

Activists[edit source]

- Jane Addams[193][194]

- Peter Barnes[195]

- Sara Bard Field[196]

- Michael Davitt[197]

- Samuel Gompers[198][199]

- Bolton Hall[200]

- Hubert Harrison[201][202]

- John Haynes Holmes[203][204]

- Stewart Headlam[205][206]

- Mary Elizabeth Lease[207]

- Benjamin C. Marsh[208][209]

- James Ferdinand Morton[210][211]

- Thomas Mott Osborne[212][213][214]

- Amos Pinchot[215][216]

- Terence V. Powderly[217]

- Samuel Seabury[218]

- Catherine Helen Spence[219]

- Helen Taylor[220]

- William Simon U'Ren[221]

- Ida B. Wells[222]

- Frances Willard[223]

Authors[edit source]

- Ernest Howard Crosby[194]

- Charles Eisenstein[224]

- Hamlin Garland[225][226]

- Fred Harrison[227]

- James A. Herne[228]

- Ebenezer Howard[229][230][231]

- Elbert Hubbard[232]

- Aldous Huxley[233]

- James Howard Kunstler[234]

- Jose Martí[235][236]

- William D. McCrackan[225]

- Albert Jay Nock[237]

- Kathleen Norris[238]

- Upton Sinclair[239][240]

- George Bernard Shaw[241]

- Leo Tolstoy[242][243]

- Charles Erskine Scott Wood[244][245]

- Frank McEachran[246][247]

Journalists[edit source]

- William F. Buckley Jr.[248]

- Timothy Thomas Fortune[249]

- Theodor Herzl[250]

- Michael Kinsley[251][252][253]

- Suzanne La Follette[254][255]

- Dylan Matthews[256][257]

- Raymond Moley[258]

- Charles Edward Russell[259]

- Jacob Riis[260][261]

- Reihan Salam[262]

- Horace Traubel[263]

- Martin Wolf[264]

- Merryn Somerset Webb[265][266]

- Brand Whitlock[267][268][269]

- Tim Worstall[270]

- Matthew Yglesias[271][272]

Artists[edit source]

- David Bachrach[273]

- John Wilson Bengough[274]

- Daniel Carter Beard[275][276][277]

- Matthew Bellamy[278]

- George de Forest Brush[279]

- Walter Burley Griffin[280][281]

- John Hutchinson[225][282]

- George Inness[283]

- Emma Lazarus[284][285]

- Agnes de Mille[286]

- Henry Churchill de Mille[287][288]

- William C. deMille[289][290]

- Francis Neilson[291][292]

- Eddie Palmieri[293]

- Banjo Paterson[294]

- Louis Prang[295]

- Will Price[296]

- Frank Stephens[297]

- Frank Lloyd Wright[298]

Philosophers[edit source]

Others[edit source]

- Roger Babson[316]

- Louis Brandeis[317][318]

- Clarence Darrow[319][320][321]

- Albert Einstein[322][323]

- Henry Ford[324]

- Spencer Heath[325][326]

- Mumia Abu-Jamal[327]

- Margrit Kennedy[328]

- John C. Lincoln[329]

- Elizabeth Magie[330][331]

- Edward McGlynn[332]

- Buckey O'Neill[333]

- George Foster Peabody[213][214]

- Louis Freeland Post[334]

- Walter Rauschenbusch

- Raymond A. Spruance[335]

- Silvanus P. Thompson[274]

- Fiske Warren[336][337]

- Alfred Russel Wallace[338]

- Joseph Fels[339]

See also[edit source]

- Agrarian Justice

- Arden, Delaware

- Basic income

- Cap and Share

- Causes of poverty

- Citizen's dividend

- Classical economics

- Classical liberalism

- Community land trust

- Deadweight loss

- Diggers

- Economic rent

- Enclosure

- Excess burden of taxation

- Externality

- Free-market environmentalism

- Freiwirtschaft

- Geolibertarianism

- Green economy

- Labor economics

- Laissez-faire

- Land (economics)

- Landed property

- Land law

- Land monopoly

- Land registration

- Land tenure

- Land value tax

- Law of rent

- Lockean proviso

- Manorialism

- Natural and legal rights

- Neoclassical liberalism

- Optimal tax

- Physiocracy

- Pigovian tax

- Poverty reduction

- Progress and Poverty

- Progressive Era

- Prosper Australia

- Radical centrism

- Rent-seeking

- Tax reform

- Tax shift

- Tragedy of the anticommons

- Value capture

- Wealth concentration

- YIMBY

References[edit source]

- ^ "Seeing the Cat". Henry George Institute. Retrieved 19 August 2018.

- ^ Foldvary, Fred. "Geoism Explained". The Progress Report. Archived from the original on March 17, 2015. Retrieved 12 January 2014.

- ^ "An Introduction to Georgist Philosophy & Activity". Council of Georgist Organizations. Archived from the original on 29 April 2019. Retrieved 28 June 2014.

- ^ a b Heavey, Jerome F. (July 2003). "Comments on Warren Samuels' "Why the Georgist movement has not succeeded"". American Journal of Economics and Sociology. 62 (3): 593–99. doi:10.1111/1536-7150.00230. JSTOR 3487813.

human beings have an inalienable right to the product of their own labor

- ^ McNab, Jane. "How the reputation of Georgists turned minds against the idea of a land rent tax" (PDF). Business School, The University of Western Australia. Archived from the original (PDF) on 12 August 2014. Retrieved 18 June2014.

- ^ Gaffney, Mason; Harrison, Fred (1994). The Corruption of Economics. London: Shepheard-Walwyn. ISBN 978-0-85683-244-4.

- ^ Hudson, Michael; Feder, Kris; and Miller, George James (1994). A Philosophy for a Fair Society Archived 2018-11-05 at the Wayback Machine. Shepheard-Walwyn, London. ISBN 978-0-85683-159-1.

- ^ Locke, John (1691). "Some Considerations of the Consequences of the Lowering of Interest and the Raising the Value of Money". Archived from the original on 2016-02-08.

- ^ Gaffney, Mason. "Logos Abused: The Decadence and Tyranny of Abstract Reasoning in Economics" (PDF). Retrieved 22 December 2013.

- ^ Agrarian Justice, Wikisource edition, paragraph 12

- ^ a b Smith, Adam (1776). "Chapter 2, Article 1: Taxes upon the Rent of Houses". The Wealth of Nations, Book V.

- ^ a b Tideman, Nicolaus; Gaffney, Mason (1994-01-01). Land and Taxation. Shepheard-Walwyn in association with Centre for Incentive Taxation. ISBN 978-0-85683-162-1.

- ^ a b Binswanger-Mkhize, Hans P; Bourguignon, Camille; Brink, Rogier van den (2009). Agricultural Land Redistribution : Toward Greater Consensus. World Bank.

A land tax is considered a progressive tax in that wealthy landowners normally should be paying relatively more than poorer landowners and tenants. Conversely, a tax on buildings can be said to be regressive, falling heavily on tenants who generally are poorer than the landlords

- ^ a b Plummer, Elizabeth (March 2010). "Evidence on the Distributional Effects of a Land Value Tax on Residential Households" (PDF). National Tax Journal. 63: 63–92. doi:10.17310/ntj.2010.1.03. S2CID 53585974. Retrieved 7 January 2015.

- ^ a b c McCluskey, William J.; Franzsen, Riël C. D. (9 October 2017). Land Value Taxation: An Applied Analysis. Ashgate. ISBN 9780754614906. Retrieved 9 October 2017 – via Google Books.

- ^ The Forgotten Idea That Shaped Great U.S. Cities by Mason Gaffney & Rich Nymoen, Commons magazine, October 17, 2013.

- ^ ""Economics" and Political Economy". Understanding Economics. Retrieved 27 March 2015.

- ^ Tideman, Nic. "Basic Principles of Geonomics". Retrieved 15 January 2015.

- ^ a b Casal, Paula (2011). "Global Taxes on Natural Resources" (PDF). Journal of Moral Philosophy. 8 (3): 307–27. doi:10.1163/174552411x591339. Retrieved 14 March2014.

"Geoism" can also invoke a philosophical tradition encompassing the views of John Locke and Thomas Paine as well as Henry George ...

- ^ "Progress and Poverty, Introduction". www.henrygeorge.org. Retrieved 9 October 2017.

- ^ "Common Rights Vs. Collective Rights". geolib.com. Retrieved 9 October 2017.

- ^ "Poverty - Earthsharing Canada". earthsharing.ca. Retrieved 9 October 2017.

- ^ Inman, Phillip (2012-09-16). "Could we build a better future on a land value tax?". The Guardian. Retrieved 14 January 2014.

- ^ Aaron, Henry (May 1974). "A New View of Property Tax Incidence". The American Economic Review. 64 (2). Retrieved 7 January 2015.[dead link]

- ^ Adam Smith, The Wealth of Nations Book V, Chapter 2, Part 2, Article I: Taxes upon the Rent of Houses

- ^ Foldvary, Fred E. "Geo-Rent: A Plea to Public Economists". Econ Journal Watch (April 2005)[1]

- ^ Stiglitz, Joseph. "Thomas Piketty and Joseph Stiglitz". INETeconomics. Retrieved 14 April 2015.

- ^ "Re:Think. Tax discussion paper for March 2015" (PDF). The Australian Government the Treasury. Archived from the original (PDF) on 2015-04-17. Retrieved 14 April 2015.

- ^ Franklin, Benjamin (1840). Memoirs of Benjamin Franklin, Volume 2. McCarty & Davis. p. 32. Retrieved 13 December2014.

- ^ Shine, Mary L. (1922). Ideas of the founders of the American nation on landed property. University of Wisconsin. p. 196.

- ^ a b George, Henry (1997). An anthology of Henry George's thought. Rochester, N.Y.: University of Rochester Press. ISBN 978-1878822819.

- ^ George, Henry (1905). Protection or Free Trade

- ^ a b c d Davies, Lindy. "The Science of Political Economy: What George "Left Out"". Economic Science Course by the Henry George Institute. Retrieved 16 June 2014.

- ^ a b c d Batt, H. William. "The Compatibility of Georgist Economics and Ecological Economics". Retrieved 9 June2014.

- ^ George, Henry (1886). Protection or Free Trade. New York: Doubleday, Page & Co.

- ^ George, Henry (1997). An Anthology of Henry George's Thought, Volume 1. University Rochester Press. p. 148. ISBN 9781878822819. Retrieved 16 June 2014.

- ^ a b Mattauch, Linus; Siegmeier, Jan; Edenhofer, Ottmar; Creutzig, Felix (2013) : Financing Public Capital through Land Rent Taxation: A Macroeconomic Henry George Theorem, CESifo Working Paper, No. 4280 http://www.econstor.eu/bitstream/10419/77659/1/cesifo_wp4280.pdf

- ^ Tideman, Nicolaus. "Using Tax Policy to Promote Urban Growth". Retrieved 9 June 2014.

- ^ a b c d Gaffney, Mason (July 3, 2008). "The Hidden Taxable Capacity of Land: Enough and to Spare" (PDF). International Journal of Social Economics (Summer 2008). Retrieved 13 June 2014.

- ^ a b c d Fitzgerald, Karl. "Total Resource Rents of Australia" (PDF). Prosper Australia. Retrieved 16 June2014.

- ^ Harriss, C. Lowell (2006). "Nonrenewable Exhaustible Resources and Property Taxation". American Journal of Economics and Sociology. 65 (3): 693–99. doi:10.1111/j.1536-7150.2006.00470.x.

- ^ George, Henry (1997). An Anthology of Henry George's Thought, Volume 1. University Rochester Press. p. 156. ISBN 9781878822819. Retrieved 16 June 2014.

- ^ George, Henry. "Scotland and Scotsmen". Archived from the original on 10 August 2014. Retrieved 16 June 2014.Address delivered on 18 February 1884 at the City Hall, Glasgow

- ^ Miller, Joseph Dana (1921). "To Hold the Sea In Fee Simple". The Single Tax Review. 21–22: 37. Retrieved 16 June 2014.

- ^ Darrow, Clarence (2014-01-14). "How to Abolish Unfair Taxation". Retrieved 15 June 2014.

- ^ Sullivan, Dan. "Are you a Real Libertarian, or a ROYAL Libertarian?". Retrieved 15 June 2014.

- ^ Post, Louis F. "Outlines of Louis F. Post's Lectures". Retrieved 15 June 2014.

- ^ Zarlenga, Stephen. "Henry George's Concept of Money (Full Text) And Its Implications For 21st Century Reform". American Monetary Institute. Archived from the originalon 2013-06-04. Retrieved 13 June 2014.

- ^ George, Henry. "On Patents and Copyrights". Retrieved 16 June 2014.

- ^ Niman, Neil B. "Henry George and the Intellectual Foundations of the Open Source Movement" (PDF). Robert Schalkenbach Foundation. Retrieved 16 June 2014.

A modern counterpart to the nineteenth century focus on land can be found in the twentieth century concern with the establishment of intellectual property rights that fence off a portion of the creative commons in order to construct temporary monopolies.

- ^ Fox, Stephen R. The American Conservation Movement: John Muir and His Legacy. Madison, WI: U of Wisconsin, 1985.

- ^ a b c Daly, Herman E., and Joshua C. Farley. Ecological Economics: Principles and Applications. Washington: Island, 2004.

- ^ Cato, Molly Scott (2013-09-02). "The Gypsy Rover, the Norman Yoke and the Land Value Tax". Retrieved 15 August 2014.

- ^ Smith, Peter (2014-01-29). "Beaver, Rewilding & Land Value Tax have the answer to the UK's Flooding Problem". Retrieved 15 August 2014.

- ^ Ikerd, John. "The Green Tax Shift: Winners and Losers". missouri.edu. Retrieved 13 June 2014.

- ^ Casal, Paula (2011). "Global Taxes on Natural Resources" (PDF). Journal of Moral Philosophy. 8 (3): 307–27. doi:10.1163/174552411X591339. Retrieved 14 June2014.

- ^ Backhaus, Jurgen, and J. J. Krabbe. "Henry George's Contribution to Modern Environmental Policy: Part I, Theoretical Postulates." American Journal of Economics and Sociology 50.4 (1991): 485-501. Weborn 14 Aug. 2014.

- ^ Cobb, Clifford. "Herman Daly Festschrift: Ecological and Georgist Economic Principles: A Comparison". Retrieved 13 June 2014.

- ^ Roark, Eric (2013). Removing the Commons: A Lockean Left-Libertarian Approach to the Just Use and Appropriation of Natural Resources. Lexington Books. ISBN 9780739174692. Retrieved 12 June 2014.

- ^ Brebbia, C. A. (2012). Ecodynamics: The Prigogine Legacy. WIT Press. p. 104. ISBN 9781845646547. Retrieved 4 June 2014.

- ^ Gluckman, Amy. "A Primer on Henry George's "Single Tax"". Retrieved 12 July 2015.

- ^ Hartzok, Alanna. "Citizen Dividends and Oil Resource Rents A Focus on Alaska, Norway and Nigeria". Retrieved 9 June 2014.

- ^ Gaffney, Mason. "A Cannan Hits the Mark" (PDF). Retrieved 9 June 2014.

- ^ Socialism, Capitalism, and Geoism – by Lindy Davies

- ^ γῆ. Liddell, Henry George; Scott, Robert; A Greek–English Lexicon at the Perseus Project.

- ^ Harper, Douglas. "George". Online Etymology Dictionary.

- ^ Introduction to Earth Sharing,

- ^ "Jeffery J. Smith - Progress.org". www.progress.org. Retrieved 9 October 2017.

- ^ Fred Foldvary. "Geoism and Libertarianism". Archived from the original on November 4, 2012. Retrieved 9 October 2017.

- ^ Curtis, Mike. "The Arden Land Trust". Retrieved 30 May2014.

- ^ Adams, Martin. "Sharing the Value of Land: The Promise of Location Value Covenants". Archived from the original on 2014-05-30. Retrieved 30 May 2014.

- ^ Kent, Deirdre. "Land and Money Reform Synergy in New Zealand". Smart Taxes. Archived from the original on 5 June 2014. Retrieved 30 May 2014.

- ^ "Cooperative Individualism - Liberty Schools" (PDF). www.cooperativeindividualism.org. Archived from the original (PDF) on 4 June 2016. Retrieved 9 October 2017.

- ^ "Location Value Covenants - Systemic Fiscal Reform". www.sfrgroup.org. Retrieved 9 October 2017.

- ^ Foldvery, Fred. "Geoanarchism A short summary of geoism and its relation to libertarianism". Archived from the original on 18 October 2017. Retrieved 29 May 2014.

- ^ Bille, Frank F. "The Danish-American Georgist". Archived from the original on 31 May 2014. Retrieved 30 May 2014.

- ^ Miller, Joseph Dana (1904). Land and Freedom: An International Record of Single Tax Progress, Volume 4. Single Tax Publishing Company. pp. 9–15.

- ^ Wolf, Martin. "Why we must halt the land cycle". Financial Times. Retrieved 29 May 2014.

- ^ Barker, Charles A. "The Followers of Henry George". Henry George News. Archived from the original on 13 January 2015. Retrieved 13 January 2015.

- ^ . 2004-08-28 https://web.archive.org/web/20070927005612/http://www.votenader.org/issues/index.php?cid=7. Archived from the original on September 27, 2007. Retrieved 2012-07-26.Missing or empty

|title=(help) - ^ "Why Henry George had a point". The Economist. 2015-04-01. Retrieved 29 June 2017.

- ^ Stiglitz, Joseph (1977). "The theory of local public goods". In Feldstein, Martin; Inman, Robert (eds.). The Economics of Public Services. London: Macmillan Publishers. pp. 274–333.

- ^ Arnott, Richard J.; Joseph E. Stiglitz (Nov 1979). "Aggregate Land Rents, Expenditure on Public Goods, and Optimal City Size" (PDF). Quarterly Journal of Economics. 93 (4): 471–500. doi:10.2307/1884466. JSTOR 1884466. S2CID 53374401.

- ^ "Fairhope Single Tax Corporation". Fairhope Single Tax Corporation. Retrieved 9 October 2017.

- ^ Davis, Stephen (1986). "Joseph Jay Pastoriza and the Single Tax in Houston, 1911–1917" (PDF). 8 (2). Houston Review: history and culture of the Gulf Coast.[permanent dead link]

- ^ Silagi, Michael; Faulkner, Susan N (1984). "Land Reform in Kiaochow, China: From 1898 to 1914 the Menace of Disastrous Land Speculation was Averted by Taxation". The American Journal of Economics and Sociology. 43 (2): 167–77. doi:10.1111/j.1536-7150.1984.tb02240.x.

- ^ Gaffney, M. Mason. "Henry George 100 Years Later". Association for Georgist Studies Board. Archived from the original on 2008-07-24. Retrieved 2008-05-12.

- ^ Harding, Robin (September 2014). "Property: Land of opportunity". Financial Times.

- ^ "City council decides to cut land value tax". Altoona Mirror. June 6, 2016.

- ^ The American Journal of Economics and Sociology, vol. 62, 2003, p. 615

- ^ "About Us – Henry George School of Social Science". hgsss.org. Henry George School of Social Science. Retrieved 29 June 2017.

- ^ "About the Lincoln Institute of Land Policy". Lincolninst.edu. Retrieved 2012-07-26.

- ^ "The Henry George Foundation". Retrieved 2009-07-31.

- ^ The IU. "The IU". Retrieved 2019-06-13.

- ^ Marshall, Alfred. “Three Lectures on Progress and Poverty by Alfred Marshall.” The Journal of Law & Economics, vol. 12, no. 1, 1969, pp. 184–226. https://www.jstor.org/stable/724986

- ^ Marshall, Alfred, Principles of Economics. 1920. Library of Economics and Liberty.

- ^ Andelson, Robert V. "Henry George and The Reconstruction Of Capitalism". Retrieved 14 January 2014.

- ^ a b Marx, Karl. "Letters: Marx-Engels Correspondence 1881". www.marxists.org. Retrieved 9 October 2017.

- ^ Fred Harrison. ""Gronlund and other Marxists – Part III: nineteenth-century Americas critics", American Journal of Economics and Sociology". findarticles.com. Retrieved 9 October 2017.

- ^ George, Henry. "A Response to Richard Ely On the Question of Compensation to Owners of Land". Archived from the original on 29 May 2014. Retrieved 29 May 2014.

- ^ Commons, John R. "The Distribution of Wealth", 1893 https://books.google.com/books?id=dhVEAAAAIAAJ

- ^ Commons, John R (1922). "A Progressive Tax on Bare Land Values". Political Science Quarterly. 37 (1): 41–68. doi:10.2307/2142317. JSTOR 2142317.

- ^ Blaug, Mark. Interview in Andelson, Robert V. Critics of Henry George: An Appraisal of Their Strictures on Progress and Poverty. Blackwell Publishing. 1979. p. 686.

- ^ a b Foldvery, Fred E. (2005). "Geo-Rent: A Plea to Public Economists" (PDF). Econ Watch. 2 (1): 106–32. Retrieved 2 October 2013.

- ^ Andelson, Robert V., ed. (21 November 2003). Critics of Henry George: An Appraisal of Their Strictures on Progress and Poverty, Vol. 1. Wiley-Blackwell. ISBN 978-1405118255.

- ^ Hudson, Michael (1994). A Philosophy for a Fair Society. ISBN 9780856831591. Retrieved 18 January 2015.

- ^ https://psmag.com/news/this-land-is-your-land-3392"urban economics models actually do suggest that Georgist taxation would be the right approach at least to finance city growth."/

- ^ Mason Gaffney (13 March 2009). "The hidden taxable capacity of land: enough and to spare". International Journal of Social Economics. 36 (4): 328–411. doi:10.1108/03068290910947930.

- ^ Foldvery, Fred. "The Ultimate Tax Reform: Public Revenue from Land Rent" (PDF). Retrieved 27 January 2014.

- ^ Steven, Cord. "How Much Revenue would a Full Land Value Tax Yield? Analysis of Census and Federal Reserve Data". American Journal of Economics and Sociology. 44 (3): 279–293.

- ^ Steven Cord, "Land Rent is 20% of U.S. National Income for 1986", Incentive Taxation, July/August 1991, pp. 1–2.

- ^ Miles, Mike (1990). "What Is the Value of all U.S. Real Estate?". Real Estate Review. 20 (2): 69–75.

- ^ Nicolaus Tideman and Florenz Plassman, "Taxed Out of Work and Wealth: The Costs of Taxing Labor and Capital", in The Losses of Nations: Deadweight Politics versus Public Rent Dividends (London: Othila Press, 1988), pp. 146–174.

- ^ Fitzgerald, Karl. "Total Resource Rents of Australia". Retrieved 27 January 2014.

- ^ Rothbard, Murray (1962). Man, Economy, and State: A Treatise on Economic Principles. Van Nostrand.

- ^ Heinrich, David J (2004-02-24). "Murray Rothbard and Henry George". www.mises.org. Retrieved 28 August 2014.

- ^ Andelson, Robert V. (January 2000). "On Separating the Landowner's Earned and Unearned Increment: A Georgist Rejoinder to F. A. Hayek". American Journal of Economics and Sociology. 59 (1): 109–17. doi:10.1111/1536-7150.00016. Hayek wrote, "It was a lay enthusiasm for Henry George which led me to economics."

- ^ Brown, H. G. "A Defense of the Single Tax Principle." The Annals of the American Academy of Political and Social Science 183.1 (1936): 63–69. Quote: "The truth is that I recognize the fundamental justice and common sense of the single-tax idea. But that any other tax than a tax on land values is always and everywhere wrong, regardless of public needs or the nature of this other tax, I do not maintain."

- ^ Harter, Lafayette G. John R. Commons, His Assault on Laissez-faire. Corvallis: Oregon State UP, 1962. pp. 21, 32, 36, 38.

- ^ "Two Centuries of Economic Thought on Taxation of Land Rents." In Richard Lindholm and Arthur Lynn, Jr., (eds.), Land Value Taxation in Thought and Practice. Madison: Univ. of Wisconsin Press, 1982, pp. 151–96.

- ^ Brue, Stanley; Randy, Grant (2012). The Evolution of Economic Thought (Supplemental Biography of John Rogers Commons for chapter 19 of the online edition of The Evolution of Economic Thought ed.). Cengage Learning."After reading Henry George's Progress and Poverty," Commons "became a single-taxer."

- ^ Crotty, Raymond D. (1988). A Radical's Response. Poolbeg. ISBN 9780905169989. Retrieved 29 August 2014.

- ^ Sheppard, Barry (2014-08-24). "'Progress and Poverty' – Henry George and Land Reform in modern Ireland". The Irish Story. Retrieved 29 August 2014.

- ^ Daly, Herman. "Smart Talk: Herman Daly on what's beyond GNP Growth". Henry George School of Social Science. Retrieved 24 October 2015.

. . . I am really sort of a Georgist.

- ^ Gaffney, Mason. "Stimulus: The False and the True Mason Gaffney". Retrieved 13 August 2015.

- ^ Douglas, Paul (1972). In the fullness of time; the memoirs of Paul H. Douglas. New York: Harcourt Brace Jovanovich. ISBN 978-0151443765.

- ^ Edenhofer, Ottmar (2013). "Hypergeorgism: When is Rent Taxation as a Remedy for Insufficient Capital Accumulation Socially Optimal?". SSRN 2232659.

Extending and modifying the tenet of georgism, we propose that this insight be called hypergeorgism." "From a historical perspective, our result may be closer to Henry George’s original thinking than georgism or the neoclassical Henry George Theorems.

- ^ Edenhofer, Ottmar (2013-06-25). "Financing Public Capital Through Land Rent Taxation: A Macroeconomic Henry George Theorem". SSRN 2284745.

- ^ Edenhofer, Ottmar. "The Triple Dividend Climate Change Mitigation, Justice and Investing in Capabilities" (PDF). Retrieved 11 November 2013.

- ^ "Foldvary policy reforms". www.foldvary.net. Retrieved 9 October 2017.

- ^ Collected Works of Milton Friedman, Hoover Institution. "Is Tax Reform Possible? (February 06, 1978)". Hoover Institution. Retrieved 30 November 2019. Excerpt: Prof. Friedman:... In my opinion, and this may come as a shock to some of you, the least bad tax is the property tax on the unimproved value of land, the Henry George argument of many, many years ago. "

- ^ "Mason Gaffney's Website". masongaffney.org. Retrieved 9 October 2017.

- ^ Gaffney, Mason. "Henry George 100 Years Later: The Great Reconciler" (PDF). Archived from the original (PDF) on 3 March 2012. Retrieved 27 January 2014.

- ^ Airlie Worrall, The New Crusade: the Origins, Activities and Influence of the Australian Single Tax Leagues, 1889–1895(M.A. thesis, University of Melbourne, 1978).

- ^ Turgeon, Lynn. Bastard Keynesianism : the evolution of economic thinking and policymaking since World War II. Westport, Conn: Praeger, 1997

- ^ Gaffney, Mason. "Warm Memories of Bill Vickrey". Land & Liberty. http://www.cooperative-individualism.org/gaffney-mason_warm-memories-of-bill-vickrey-1997.htmArchived 2016-11-16 at the Wayback Machine

- ^ Gaffney, Mason, and Fred Harrison. The corruption of economics. London: Shepheard-Walwyn in association with Centre for Incentive Taxation, 2006

- ^ Hotelling, Harold. “The General Welfare in Relation to Problems of Taxation and of Railway and Utility Rates.” Econometrica, vol. 6, no. 3, 1938, pp. 242–69. https://www.jstor.org/stable/1907054.

- ^ Andelson Robert V. (2000). Land-Value Taxation Around the World: Studies in Economic Reform and Social Justice Malden. MA:Blackwell Publishers, Inc. p. 359.

- ^ Knack, Ruth Eckdish. "Pay As You Park: UCLA professor Donald Shoup inspires a passion for parking" (May 2005). Planning Magazine. Retrieved 17 September 2014.

- ^ Shoup, Donald C. "The Ideal Source of Local Public Revenue." Regional Science and Urban Economics 34.6 (2004): 753-84.

- ^ Washington, Emily (2012-08-07). "The High Cost of Free Parking Chapters 19–22". marketurbanism.com. Market Urbanism. Retrieved 17 September 2014.

- ^ Quotes from Nobel Prize Winners Herbert Simon stated in 1978: "Assuming that a tax increase is necessary, it is clearly preferable to impose the additional cost on land by increasing the land tax, rather than to increase the wage tax – the two alternatives open to the City (of Pittsburgh). It is the use and occupancy of property that creates the need for the municipal services that appear as the largest item in the budget – fire and police protection, waste removal, and public works. The average increase in tax bills of city residents will be about twice as great with wage tax increase than with a land tax increase."

- ^ Stiglitz, Joseph (2 December 2010). "Working Paper No. 6: Principles and Guidelines for Deficit Reduction" (PDF). Next New Deal The Blog of the Roosevelt Institute. The Roosevelt Institute. p. 5. Archived from the original (PDF)on 6 December 2010. Retrieved 22 February 2017.

One of the general principles of taxation is that one should tax factors that are inelastic in supply, since there are no adverse supply side effects. Land does not disappear when it is taxed. Henry George, a great progressive of the late nineteenth century, argued, partly on this basis, for a land tax.

- ^ Tideman, Nicolaus. "Global Economic Justice". Schalkenbach Foundation. Archived from the original on June 29, 2013. Retrieved 8 October 2013.

- ^ "Bill Vickrey: "This paper would benefit from an application of Henry George's idea of taxing land values!"". www.wealthandwant.com. Retrieved 9 October2017.

- ^ Netzer, Dick (November 1996). "Remembering William Vickrey". Land Lines. 8 (6). Retrieved 2 September 2016.

- ^ Vickrey, William. "The Corporate Income Tax in the U.S. Tax System, 73 TAX NOTES 597, 603 (1996). Quote: "Removing almost all business taxes, including property taxes on improvements, excepting only taxes reflecting the marginal social cost of public services rendered to specific activities, and replacing them with taxes on site values, would substantially improve the economic efficiency of the jurisdiction."

- ^ Cirillo, Renato (Jan 1984). "Léon Walras and Social Justice". The American Journal of Economics and Sociology. 43 (1): 53–60. doi:10.1111/j.1536-7150.1984.tb02222.x. JSTOR 3486394.

- ^ Barker, Charles A., 1955. Henry George. New York: Oxford University Press

- ^ Hudson, Michael (1994). A philosophy for a fair society (Georgist Paradigm Series) (paperback ed.). Shepheard-Walwyn.

- ^ "Has Georgism been hijacked by special interests?"(PDF).

- ^ Boast, Richard (2008). Buying the land, selling the land : governments and Maori land in the North Island 1865–1921. Wellington N.Z: Victoria University Press, Victoria University of Wellington. ISBN 9780864735614.

- ^ Daunton, M. J. State and market in Victorian Britain : war, welfare and capitalism. Woodbridge, UK Rochester, NY: Boydell Press, 2008. Quote: "In the election of 1890 he campaigned for radical land reform, arguing for a tax on the 'unearned increment', and advocated the programme of Henry George as a means of 'bursting up the great estates'."

- ^ "Winston S. Churchill / The Mother of all Monopolies -- 1909".

- ^ MacLaren, Andrew (Autumn 2001). "The People's Rights: Opportunity Lost?". Finest Hour. 112. Retrieved 15 August2015.

- ^ Dugan, Ianthe Jeanne (March 17, 2013). "It's a Lonely Quest for Land-Tax Fans, But, by George, They Press On". Wall Street Journal. Retrieved 25 August 2014.

- ^ Stevens, Elizabeth Lesly. "A Tax Policy With San Francisco Roots". July 30, 2011 https://www.nytimes.com/2011/07/31/us/31bcstevens.htmlQuote: "But Mr. Brown was certainly in good company as a Georgist. Devotees over the years have included Leo Tolstoy, Winston Churchill, Sun Yat-Sen, and the inventor of the board game that would become Monopoly."

- ^ Murdoch, Walter. Alfred Deakin: a sketch. Melbourne, Vic: Bookman, 1999. [1923]

- ^ Bastian, Peter (2009). Andrew Fisher: An Underestimated Man. Sydney, N.S.W: UNSW Press. pp. 28–30. ISBN 978-1742230047.

- ^ [George, Henry, Jr. The Life of Henry George. New York: Doubleday & McClure, 1900.]

- ^ Hayes, Rutherford B. "Henry George". Archived from the original on 3 December 2013. Retrieved 26 November2013.

- ^ "Hughes, William Morris (Billy) (1862–1952)". Australian Dictionary of Biography: Online Edition.

- ^ Stout, Robert (14 April 1885). "ADDRESS BY THE HON. R. STOUT" (Volume XXII, Issue 7302). PAPERPAST. New Zealand Herald. Retrieved 6 December 2014.

- ^ Trescott, Paul B. (January 22, 1994). "Henry George, Sun Yat-sen and China: More Than Land Policy Was Involved". American Journal of Economics and Sociology. 53 (3): 363–375. doi:10.1111/j.1536-7150.1994.tb02606.x – via Wiley Online Library.

- ^ Trescott, Paul B. (2007). Jingji Xue: The History of the Introduction of Western Economic Ideas Into China, 1850–1950. Chinese University Press. pp. 46–48. ISBN 9789629962425.

The foregoing help to demonstrate why Sun Yat-sen would have regarded Henry George as a very credible guide, and why in 1912 Sun could tell an interviewer, 'The teachings of your single-taxer, Henry George, will be the basis of our program of reform.'

- ^ Post, Louis Freeland (April 12, 1912). "Sun Yat Sen's Economic Program for China". The Public. 15: 349. Retrieved 8 November 2016.

land tax as the only means of supporting the government is an infinitely just, reasonable, and equitably distributed tax, and on it we will found our new system

- ^ Altgeld, John (1899). Live Questions (PDF). Geo. S Bowen & Son. pp. 776–81. Archived from the original(PDF) on 2014-09-24.

- ^ Chicago Single Tax Club collection, Special Collections and University Archives, University of Illinois at Chicago http://findingaids.library.uic.edu/ead/rjd1/ChiSingleTaxf.html

- ^ a b c Gaffney, Mason. "Henry George 100 Years Later: The Great Reconciler". Robert Schalkenbach Foundation. Retrieved 3 September 2014.

- ^ Finegold, Kenneth (1995). Experts and politicians: reform challenges to machine politics in New York, Cleveland, and Chicago. Princeton, N.J: Princeton University Press. ISBN 978-0691037349.

- ^ Stevens, Elizabeth Lesly (July–August 2012). "The Power Broker". Washington Monthly. July/August 2012. Retrieved 8 December 2013.

- ^ Cameron, Clyde. "REVENUE THAT IS NOT A TAX". Retrieved 18 February 2015.

- ^ "Single Tax Loses, But Mayor Favoring This Reform Is Chosen By a Small Vote Margin". The Milwaukee Journal. Mar 6, 1912. Retrieved 23 August 2014.

- ^ Arnesen, Eric. Encyclopedia of U.S. Labor and Working-class History. New York: Routledge, 2007

- ^ Johnston, Robert D. The Radical Middle Class: Populist Democracy and the Question of Capitalism in Progressive Era Portland, Oregon. Princeton, N.J: Princeton University Press, 2003

- ^ Gaynor, William Jay. Some of Mayor Gaynor's Letters and Speeches. New York: Greaves Pub., 1913. 214–21. https://books.google.com/books?id=-7kMAAAAYAAJ&pg=PA219#v=onepage

- ^ Howe, Frederic C. The Confessions of a Reformer. Kent, OH: Kent State UP, 1988.

- ^ Arcas Cubero, Fernando: El movimiento georgista y los orígenes del Andalucismo : análisis del periódico "El impuesto único" (1911–1923). Málaga : Editorial Confederación Española de Cajas de Ahorros, 1980. ISBN 84-500-3784-0

- ^ "Single Taxers Dine Johnson". New York Times May 31, 1910.

- ^ "Henry George". Ohio History Central: An Online History of Ohio History.

- ^ "Frank de Jong: Economic Rent Best Way to Finance Government". Retrieved 9 November 2013.

- ^ Gaffney, Mason. "What's the matter with Michigan? Rise and collapse of an economic wonder" (PDF). Retrieved 28 April 2014.

- ^ Cleveland, Polly. "The Way Forward for Detroit? Land Taxes". Washington Spectator. Archived from the original on 28 April 2014. Retrieved 28 April 2014.

- ^ Gaffney, Mason. "New Life in Old Cities" (PDF). UC Riverside. Retrieved 28 April 2014.

- ^ Bryson, Phillip (2011). The economics of Henry George : history's rehabilitation of America's greatest early economist. New York: Palgrave Macmillan. p. 145.

- ^ Moore, Robert (1974). Pit-men, preachers & politics the effects of Methodism in a Durham mining community. Cambridge: Cambridge University Press. p. 61.

- ^ Barton, Stephen E. (2016). "Berkeley Mayor J. Stitt Wilson: Christian Socialist, Georgist, Feminist". American Journal of Economics and Sociology. 75 (1): 193–216. doi:10.1111/ajes.12132. hdl:10.1111/ajes.12132. ISSN 0002-9246.

- ^ "Some Suggestions for Reform of Taxation", Proceedings, 14th Annual Convention, League of California Municipalities, Santa Barbara, California, October 25, 1911, pp. 152–71. J. Stitt Wilson, "Report from California", The Single Tax Review, V.17, No.1, January–February 1917, pp. 50–52

- ^ a b Stewart, John, 1931- (2001). Standing for justice : a biography of Andrew MacLaren, MP. London: Shepheard-Walwyn. ISBN 0856831948. OCLC 49362105.

- ^ Baron, Ian (September 1986). "Nkomo Debt to George in Banned Talk" (PDF). Land & liberty. London: HGFUK. Retrieved 2020-07-30.

- ^ Martín Rodríguez, Manuel (2000). "La Liga Española para el Impuesto Único y la Hacienda Municipal de Sevilla en 1914" (PDF). Revista de Estudios Regionales (56): 245. ISSN 0213-7585.

- ^ Jones, Carolyn C. (Spring 1997). "Taxing Women: Thoughts on a Gendered Economy: Symposium: A Historical Outlook: Taxes and Peace" A Case Study of Taxing Women". Southern California Review of Law and Women's Studies Southern California Review of Law and Women's Studies. Archived from the original on 8 December 2014. Retrieved 5 December 2014.

- ^ a b Rothbard, Murray (2007). Left and Right: A Journal of Libertarian Thought (Complete, 1965–1968). Ludwig von Mises Institute. p. 263. ISBN 9781610160407. Retrieved 5 December 2014.

- ^ Chris Oestereich. "With Liberty and Dividends for All: An Interview with Peter Barnes"; https://medium.com/@costrike/with-liberty-and-dividends-for-all-an-interview-with-peter-barnes-2d3cbd95028c

- ^ Beth Shalom Hessel. "Field, Sara Bard"; http://www.anb.org/articles/15/15-00220.html; American National Biography Online April 2014. Access Date: Mar 22 2015

- ^ Lane, Fintan. The Origins of Modern Irish Socialism, 1881–1896.Cork University Press, 1997 (pp. 79, 81).

- ^ Miller, Joseph Dana (1921). "Mr. Samuel Gompers Replies to Our Criticism". The Single Tax Review. 21–22: 42. Retrieved 31 August 2014.

- ^ Gompers, Samuel (1986). The Samuel Gompers Papers: The making of a union leader, 1850–86, Volume 1. University of Illinois Press. pp. 431–32. ISBN 9780252011375. Retrieved 31 August 2014.

- ^ Leubuscher, F. C. (1939). Bolton Hall ArchivedDecember 14, 2010, at the Wayback Machine. The Freeman. January issue.

- ^ Miller, Joseph Dana (1921). The Single Tax Review, Volumes 21–22. p. 178. Retrieved 16 December 2014.

- ^ Land and Freedom, Volumes 22–23. 1922. p. 179. Retrieved 16 December 2014.

- ^ "The Land Question Quotations from Historical and Contemporary Sources". Archived from the original on 1 November 2014. Retrieved 5 December 2014. Holmes said, "The passing years have only added to my conviction that Henry George is one of the greatest of all modern statesmen and prophets."

- ^ Eckert, Charles R. "Henry George, Sound Economics and the "New Deal"". Archived from the original on 4 June 2016. Retrieved 5 December 2014.

- ^ Thompson, Noel. Political economy and the Labour Party: The economics of démocratic socialism (1884–2005). Routlegde Ed., 2006, pp. 54–55.

- ^ Haggard, Robert (2001). The persistence of Victorian liberalism : the politics of social reform in Britain, 1870–1900. Westport, Conn: Greenwood Press. ISBN 978-0313313059.

- ^ Orr, B. S. (2006–2007). Mary Elizabeth Lease: Gendered discourse and Populist Party politics in Gilded Age America. Kansas History: A Journal of the Central Plains, 29, 246–265.

- ^ Caves, Roger W. Encyclopedia of the City. Abingdon, Oxon, OX: Routledge, 2005.

- ^ Marsh, Benjamin Clarke. Lobbyist for the People; a Record of Fifty Years. Washington: Public Affairs, 1953.

- ^ "Single-Taxers again laud Henry George" (PDF). Daily Standard Union. Brooklyn, NY. Sep 8, 1912. p. 12. Retrieved Nov 7, 2014.

- ^

- "British MP guest at George dinner" (PDF). Daily Standard Union. Brooklyn, NY. Sep 6, 1912. p. 9. Retrieved Nov 7, 2014.

- "Community Club" (PDF). Silver Creek News. Silver Creek, NY. Jan 4, 1916. p. 1. Retrieved Nov 7, 2014.

- "James F. Morton at Eagle Temple" (PDF). Jamestown Evening Journal. Jamestown, NY. Jan 23, 1917. p. 10. Retrieved Nov 7, 2014.

- "Meetings this evening; Labor Forum" (PDF). Jamestown Evening Journal. Jamestown, NY. Mar 30, 1918. p. 12. Retrieved Nov 7, 2014.

- "F. P. Morgan(sic) gives instructive talk on the single tax" (PDF). The Saratogian. Saratoga Springs, NY. Apr 10, 1929. p. 9. Retrieved Nov 7, 2014.

- Morton, James F., Jr. (July–August 1918). "Report of James F. Morton, Jr.'s Lecture Work". The Single Tax Review. 18 (4): 116. Retrieved Nov 7, 2014.

- "Single taxer to speak" (PDF). Buffalo Courier. Buffalo, NY. Apr 7, 1916. p. 9. Retrieved Nov 7, 2014.

- "Plans single tax talk" (PDF). Buffalo Courier. Buffalo, NY. Apr 14, 1916. p. 10. Retrieved Nov 7, 2014.

- "Single tax advocate lectures in church" (PDF). Buffalo Courier. Buffalo, NY. Apr 17, 1916. p. 6. Retrieved Nov 7,2014.

- "Meetings this evening; Meeting of the Men's club"(PDF). Jamestown Evening Journal. Jamestown, NY. Apr 25, 1916. p. 14. Retrieved Nov 7, 2014.

- "Philosophy of the Single Tax" (PDF). Jamestown Evening Journal. Jamestown, NY. Apr 26, 1916. p. 7. Retrieved Nov 7, 2014.

- "Season's close at Chautauqua; The Single Tax" (PDF). Jamestown Evening Journal. Jamestown, NY. Aug 28, 1916. p. 9. Retrieved Nov 7, 2014.

- "Exclusive tax on land values" (PDF). Jamestown Evening Journal. Jamestown, NY. Jan 15, 1917. p. 3. Retrieved Nov 7, 2014.

- "Saturday Night Club" (PDF). Jamestown Evening Journal. Jamestown, NY. Jan 12, 1917. p. 9. Retrieved Nov 7, 2014.

- "Lewiston" (PDF). Buffalo Evening News. Buffalo, NY. Apr 30, 1917. p. 10. Retrieved Nov 7, 2014.

- "Greenfield Center" (PDF). The Saratogian. Saratoga Springs, NY. Nov 13, 1917. p. 7. Retrieved Nov 7, 2014.

- "Church Services Tomorrow; First Congregational Church" (PDF). Daily Argus. Mount Vernon, NY. Dec 3, 1917. p. 12. Retrieved Nov 7, 2014.

- ^ Jorgensen, Emil Oliver. The next Step toward Real Democracy: One Hundred Reasons Why America Should Abolish, as Speedily as Possible, All Taxation upon the Fruits of Industry, and Raise the Public Revenue by a Single Tax on Land Values Only. Chicago, IL: Chicago Singletax Club, 1920.

- ^ a b Gorgas, William Crawford, and Lewis Jerome Johnson. Two Papers on Public Sanitation and the Single Tax. New York: Single Tax Information Bureau, 1914. https://books.google.com/books?id=v3NHAAAAYAAJ

- ^ a b Ware, Louise. George Foster Peabody, Banker, Philanthropist, Publicist. Athens: U of Georgia, 1951. http://dlg.galileo.usg.edu/ugapressbks/pdfs/ugp9780820334561.pdf

- ^ Young, Arthur Nichols (1916). Single tax Movement in the United States. S.l: Hardpress Ltd.

- ^ Thompson, John (1987). Reformers and war : American progressive publicists and the First World War. Cambridge Cambridgeshire New York: Cambridge University Press.

- ^ Powderly, Terence Vincent (1889). Thirty Years of Labor. 1859–1889. Excelsior publishing house. Retrieved 8 December 2014. "It would be far easier to levy a "single tax," basing it upon land values." "It is because […] a single land tax would prove to be the very essence of equity, that l advocate it.

- ^ Mitgang, Herbert (1996). The Man Who Rode the Tiger: The Life and Times of Judge Samuel Seabury. Fordham Univ Press. ISBN 9780823217229.

- ^ Magarey, Susan (1985). Unbridling the tongues of women : a biography of Catherine Helen Spence. Sydney, NSW: Hale & Iremonger. ISBN 978-0868061498.

- ^ Wenzer, Kenneth (1997). An Anthology of Henry George's Thought (Volume 1). University Rochester Press. pp. 87, 243. ISBN 9781878822819.

- ^ "Oregon Biographies: William S. U'Ren". Oregon History Project. Portland, Oregon: Oregon Historical Society. 2002. Archived from the original on 2006-11-10. Retrieved 2006-12-29.

- ^ Candeloro, Dominic (April 1979). "The Single Tax Movement and Progressivism, 1880–1920". American Journal of Economics and Sociology. 38 (2): 113–27. doi:10.1111/j.1536-7150.1979.tb02869.x. Archived from the original on 17 July 2015. Retrieved 16 July 2015.

- ^ "The Inquisitive Voter". The Great Adventure. 4 (35). September 11, 1920.

The proposition of Henry George will do more to lift humanity from the slough of poverty, crime, and misery than all else.

- ^ Eisenstein, Charles. "Post-Capitalism". Archived from the original on 6 October 2014. Retrieved 5 October 2014.

- ^ a b c "The Funeral Procession" (PDF). New York Times. November 1, 1897. Retrieved 17 November 2013.

- ^ Newlin, Keith (2008). Hamlin Garland a life. Lincoln: University of Nebraska Press. pp. 102–27. ISBN 978-0803233478.

- ^ https://www.youtube.com/watch?v=vviBboUXhuA Fred Harrison speaks at ALTER Spring Conference 2014

- ^ Aller, Pat. "The Georgist Philosophy in Culture and History". Retrieved 2 October 2014.

- ^ Steuer, Max (June 2000). "REVIEW ARTICLE A hundred years of town planning and the influence of Ebenezer Howard". The British Journal of Sociology. 51 (2): 377–86. doi:10.1111/j.1468-4446.2000.00377.x. PMID 10905006.

- ^ Meacham, Standish (1999). Regaining Paradise: Englishness and the Early Garden City Movement. Yale University Press. pp. 50–53. ISBN 978-0300075724. Retrieved 5 August 2014.

- ^ Purdom, Charles Benjamin (1963). The Letchworth Achievement. p. 1. Retrieved 5 August 2014.

- ^ Hubard, Elbert (1907). Little Journeys to the Homes of Great Reformers. East Aurora, New York: The Roycrofters. Retrieved 6 July 2016.

- ^ Harrison, F. (May–June 1989). "Aldous Huxley on 'the Land Question' Archived 2014-12-13 at the Wayback Machine". Land & Liberty. "Huxley redeems himself when he concedes that, if he were to rewrite the book, he would offer a third option, one which he characterised as 'the possibility of sanity.' In a few bold strokes he outlines the elements of this model: 'In this community economics would be decentralist and Henry Georgian, politics Kropotkinesque and co-operative.'"

- ^ Kunstler, James Howard (1998). "Chapter 7". Home from Nowhere: Remaking Our Everyday World For the 21st Century. Simon and Schuster. ISBN 9780684837376.

- ^ Mace, Elisabeth. "The economic thinking of Jose Marti: Legacy foundation for the integration of America". Archived from the original on 8 September 2015. Retrieved 5 August 2015.

- ^ Hudson, Michael. "Speech to the Communist Party of Cuba". Retrieved 5 August 2015.

- ^ Lora, Ronald; Longton, William Henry, eds. (1999). The Conservative Press in Twentieth-century America. Greenwood Publishing, Inc. p. 310. "Thus, the Freeman was to speak for the great tradition of classical liberalism, which [Albert Jay Nock and Francis Nielson] were afraid was being lost, and for the economics of Henry George, which both men shared."

- ^ Norris, Kathleen. "The Errors of Marxism". Archived from the original on 13 December 2014. Retrieved 21 November 2013.

- ^ Sinclair, Upton. "The Consequences of Land Speculation are Tenantry and Debt on the Farms, and Slums and Luxury in the Cities". Retrieved 3 November 2014.Sinclair was an active georgist but eventually gave up on explicitly advocating the reform because, "Our opponents, the great rich bankers and land speculators of California, persuaded the poor man that we were going to put all taxes on this poor man's lot."

- ^ Gaffney, Mason. "Excerpts from The Corruption of Economics". Retrieved 3 November 2014.

- ^ George Bernard Shaw, his life and works. Stewart & Kidd Company. 1911.

- ^ A Great Iniquity.. Leo Tolstoy once said of George, "People do not argue with the teaching of George, they simply do not know it".